Introduction

Getting into an accident is an unfortunate event, even if there are no injuries. It is important to know exactly what to do in the event of an accident and how the car insurance claims process works. There are certain things that should be done at the scene of the accident and other procedures along the way that will continue with the car insurance claim's process.

Considering the millions of cars on the streets of America, it is no surprise that millions of people each year are injured in auto accidents. According to the National Highway Traffic Safety Administration, in 2007, 41,059 people lost their lives in car crashes, and 2.5 million people were injured. Knowing about car insurance claims is an absolute must for every licensed driver in America.

Step 1

Before Filing car insurance claims

Comprehensive coverage insures your car in case of vandalism, theft, natural disasters, or hitting an animal. Collision coverage insures your car in case of collision with another car while driving. Your insurance premium is not affected by comprehensive claims, but they may be affected by collision car insurance claims. If you are at fault in a collision, your rate increase will depend on the extent of damage and whether there were injuries. Your insurance company will raise your premium or cancel the policy. If your car’s damage is minimal, seriously consider whether it is worth filing car insurance claims by considering the value of your car and the deductible.

Step 2

The Comprehensive Loss Underwriting Exchange (CLUE) database contains your claim's history. A CLUE report is available free of charge.

Step 3

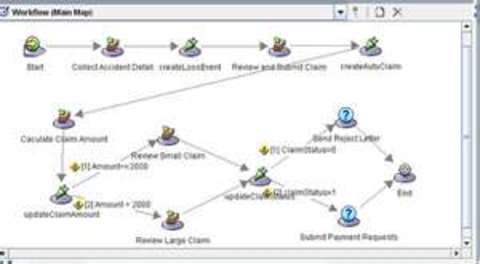

After you have been in an accident, you must get medical help if there are any injuries. Remain at the scene and call the police, so the accident can be reported. It is vital that you do not admit fault to anyone and only speak to the police officer about what happened. Gather all the information of the parties involved, so you have it on hand when filing car insurance claims. Call your insurance company and follow the prompts to file a claim. The representative will make sure they have everything they need from you to begin the investigation and will send out an adjuster to inspect your vehicle.

Step 4

In addition to filing actual car insurance claims, there are aspects of your insurance coverage that you should be aware of. Inquire about personal injury protection and see if this is included in your policy. Personal Injury Protection, (PIP), may also be referred to as “MedPay” in some states. It is a type of no-fault coverage that takes care of the lost wages, medical expenses and other types of out-of-pocket costs that you incur, whether the accident is your fault or not.

Another aspect to be aware of when dealing with car insurance claims; is whether or not you have coverage against uninsured motorists. Although it is a requirement to be covered, a good number of drivers are not insured. This type of coverage protects you and handles your claims, if you are in an accident with an uninsured motorist.

Step 5

How to File an Accident Claim

At the scene of the accident, make sure to exchange pertinent information with the other driver, including their name, address, phone number, and insurance information. Ask accident witnesses for their names and phone numbers. Call the police and file an accident report.

Notify your insurance company as soon as possible. An insurance adjuster will determine who is at fault. If you were not at fault, either your insurance company or the other party’s insurance company can handle the repair or replacement of your car. By using the other's insurance company, you will not have to file car insurance claims with your insurance company, nor pay the deductible.

Tips

Make sure you have closely read your policy.

Call the police and file an accident report.

Call your insurance company and follow the prompts to file a claim.

Sources and Citations

www.bankrate.com/brm/news/insurance/steps-file-auto1.asp

www.auto-insurance-claim-advice.com

Comments

Most Recent Articles

-

How To Find the Best Insurance Claim

Insurance is an important concept in terms of safety and security in life. Once we start earning, we must select a proper insurance plan based on the needs and subjects of insurance. Insuran...