Introduction

If you look around yourself and scrutinize, you will be able to find out that there are so many ways that you can save onto what huge fortunes you are spending for college at the moment. The extent of the college savings depends entirely on you and how you go about executing the tactics involved. You need to look around, keep an eye open for all sorts of possibilities and avail the options you have wisely. There are some important procedural steps involved that will aid you thinking and will enable you to boost your college savings.

Step 1

Firstly, you should make sure that you start your search well in time. There is a lot of planning involved and several steps to be followed before you can decide on one college for yourself. Once you have defined a clear objective in your mind, it will be easier to chalk out the level of college savings that you will need. Furthermore, you can then analyze and struggle for the required levels of finance.

Step 2

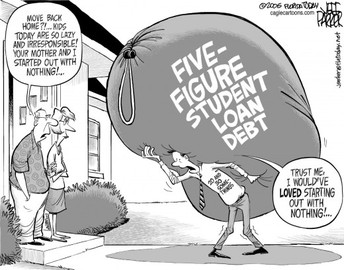

Secondly, pay off all your debts. If not all, then a majority of your debts should be paid off so that you have enough capacity to attend to your college expenses. If you have some college savings piled up already, it is great but if you plan on increasing your debt levels with this college attending make sure you make arrangements for the finances well ahead of time.

Step 3

Thirdly, you can set up an automatic saving system. This way you will never know of how much you have actually saved and will not tend to spend the savings. These college savings will eventually rescue you from the struggle of finance collecting when your tuition fee becomes due.Moreover, you can apply for lines of credit for students. This will enable you to cover a great majority of your costs such as those of books and other necessities. It would, thus, again add to your level of college savings indirectly.Joining a credit union can also prove to be a helpful point. After having conducted thorough research, you can select the bank you wish to build ties with and hence obtain some amount of credit from them if you are low on your college savings.

Step 4

Fourthly, get some grants such as those offered by FAFSA. This will really lessen your burden as you would not have to pay back the amount granted to you and it can be counted as part of your college savings.A further point can be considered when wanting to add to your college savings is that you can claim grants if you register yourselves as independent individuals, not living with your families and not relying on the payment of their taxes.

Step 5

The quickest way to generate more funds for your college savings is to try and pay your bills on time. This will cut off the additional amounts of interests and penalties that you will otherwise have to pay.If you plan ahead of time, you can also keep track of all your spending for the year and then compare them with your bank statements on a yearly basis. This will give you a chance to evaluate if you are wasting money and how long it would be before you would have some money for college savings.

Tips

The highlight of the guidelines remains: Try not going for vacations during the summer or spring breaks and instead use the money for your college savings!

So sufficient college savings will determine if you get good jobs, college savings will ensure that your dreams are fulfilled. So follow these and reach up the sky!

Sources and Citations

http://www.savvysugar.com/Tips-College-Savings-8817990

http://www.getrichslowly.org/blog/2006/08/30/27-money-tips-for-college-students/

Comments

Most Recent Articles

-

Discover 8 Tips For Savings College

College can be one of the more expensive investments that we can make in life. We will spend all the way from 2 to 12 years pursuing our degree of choice and each year can cost anywhere from...