Introduction

One of the most major questions when going to buy a life insurance is “How much is life insurance whole?” The answer depends on the condition of a person and varies from person to person. You should definitely talk to a licensed insurance agent to get the answer to this question, but below are some guidelines which you should consider.

Nobody wants to buy too much life insurance whole and neither does anyone wantt to buy less of it. Life insurance whole is bought for those whom we care about so that they may not get any financial burdens. Therefore, it is very important that you calculate how much life insurance whole you need by evaluating all your debts and loans in addition to the needs of your loved ones in the future.

The most important thing to consider is that your loved ones are going to be in a lot of emotional distress. Therefore, it is essential that you don’t leave any financial or debts stress which would increase their troubles and worries. This way, it is necessary that your loved ones can get that much money from life insurance whole and they can pay any outstanding loans. Make a list of all your debts on a paper, particularly about your home mortgage, car loans, credit card debts, and any other loans. Now you have a list of all your outstanding loans that your life insurance whole will have to pay.

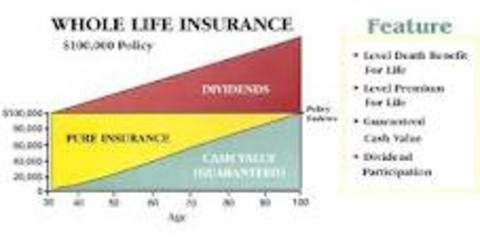

Detail

The next method is a little trickier and requires a bit work. You should have enough money in your life insurance whole that any minor aged children can be raised and your spouse’s living expenses can be paid. It is a difficult task to predict something like this but you can try to work out an estimate by figuring out the present cost of living and adding in any extra expenses that may result when your spouse has to bring up children alone. Work this out every month and you’ll be able to get an estimate.

After figuring out the cost of living, you’ll have to see that after your death, what type of income will come. Does your spouse earn? After your death, will there be other sources of income?

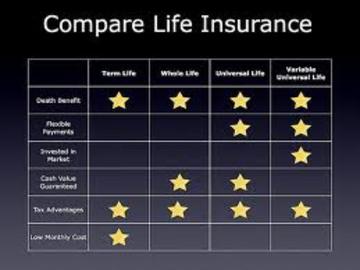

Features

Subtract the estimated monthly expenses from the income that will come and multiply the answer by 12 (to know the annual expenses) and then by the number of years that you will provide this support to your loved ones. The answer that will come will be the amount you will need to provide to fulfill your family’s future expenses.

The last thing to consider is the large expenses that are not made on a monthly basis but it still requires a large amount of money like college tuitions, weddings, etc. Evaluate the total of all these items.

Comments

Now you can calculate the total of all your loans, your future living expenses, and other big expenses for which you have to provide money for. If you have any savings or liquid assets, subtract that from this amount and you now know the amount of life insurance whole that you’ll need.

As stated above, you should talk directly to a licensed insurance agent who would be able to evaluate your personal conditions and give an estimate of how much life insurance whole you need to buy.